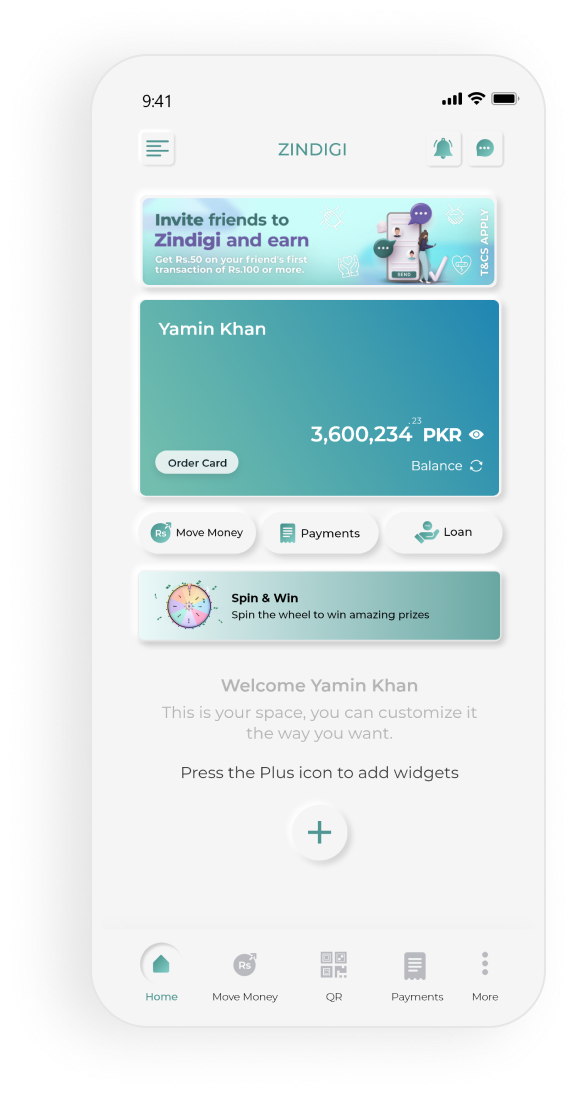

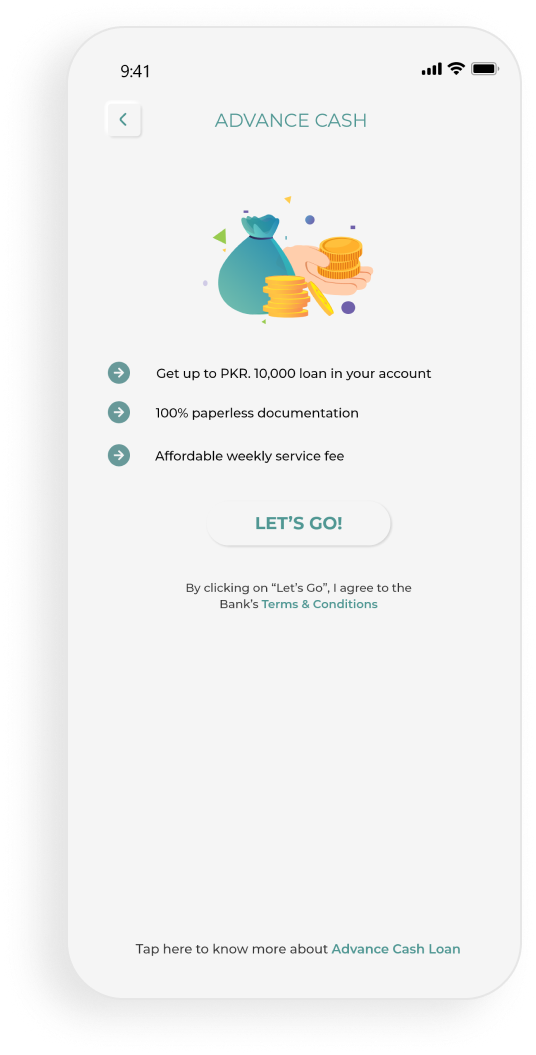

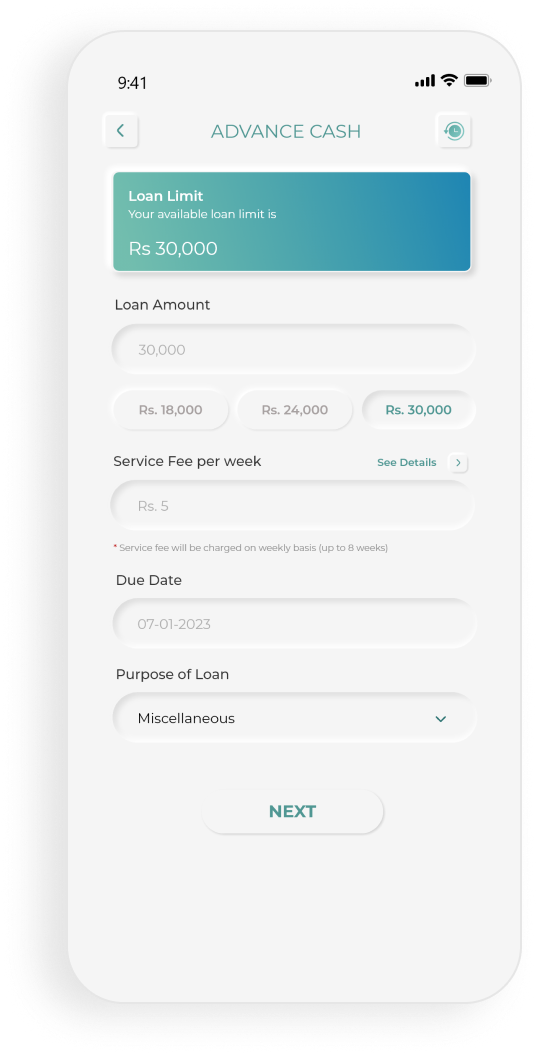

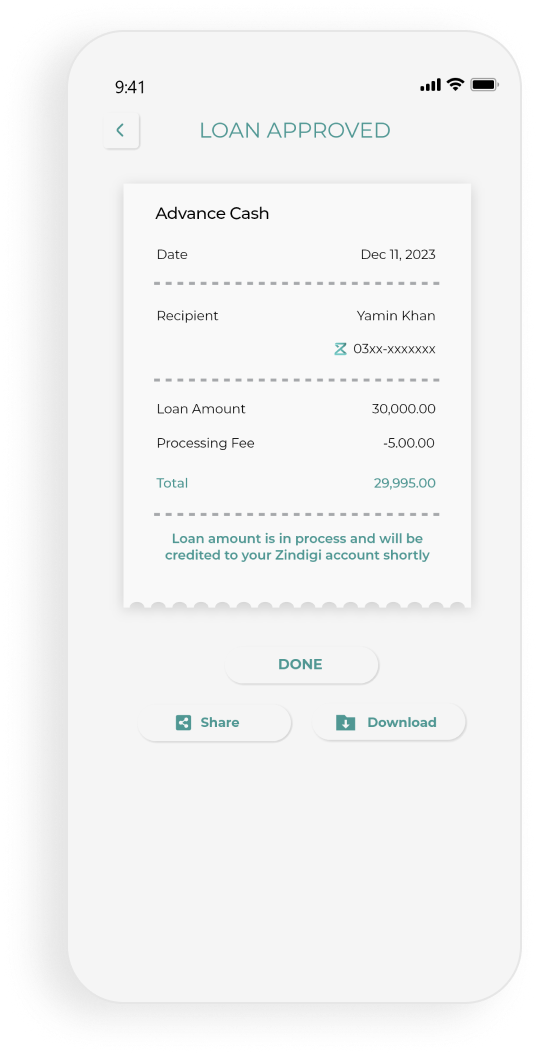

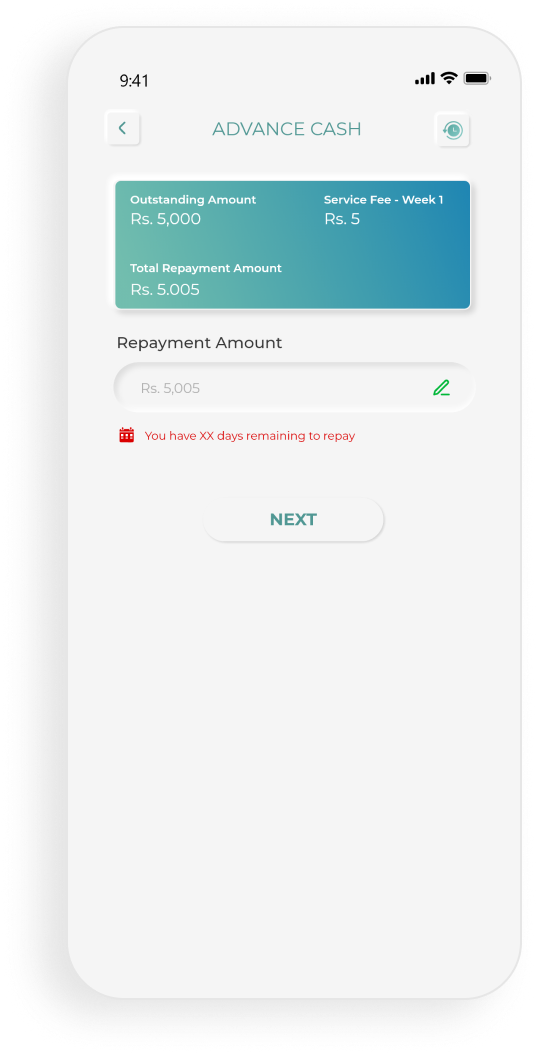

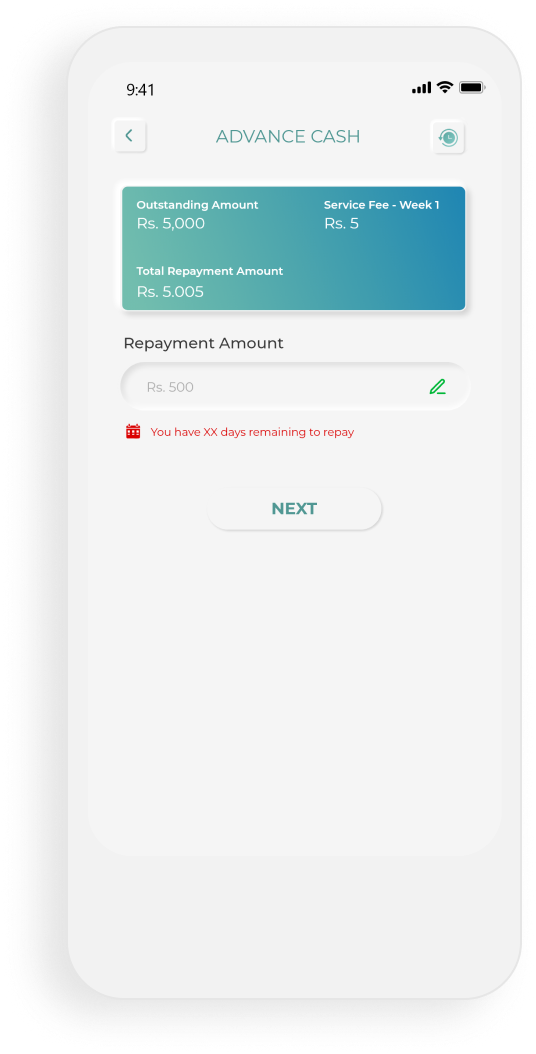

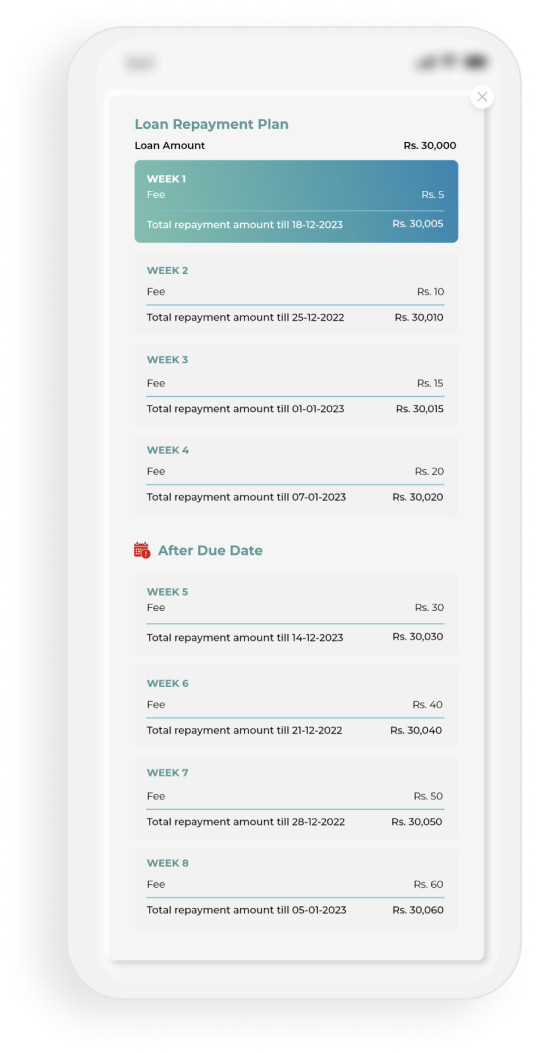

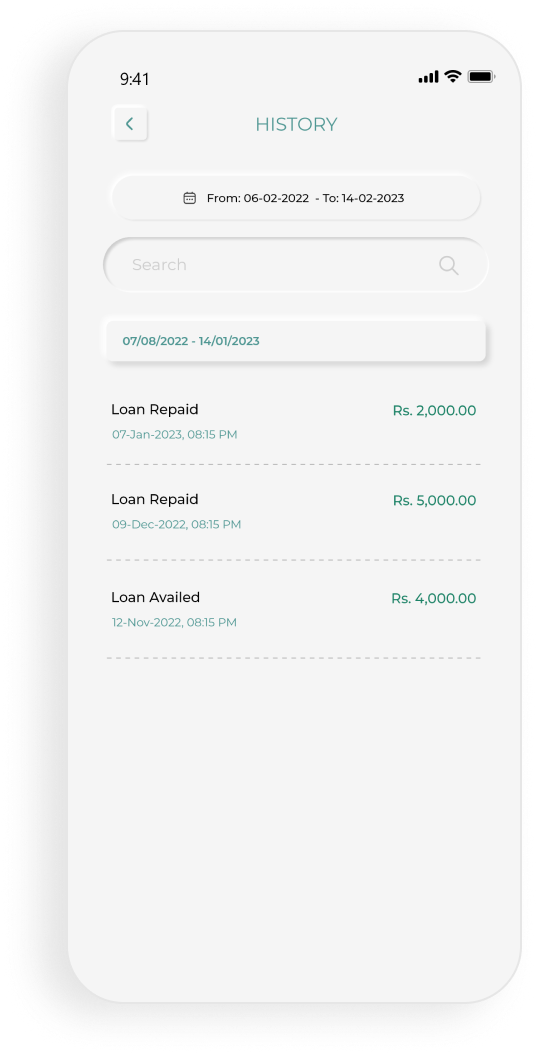

Advance Cash

Are you searching for a solution to your financial worries? Look no further!

Zindigi proudly introduces Advance Cash, your trusted lending companion for meeting

immediate financial needs, where your data protection is our priority, and transparency

rules the game with no hidden charges.

Ready to redefine the way you borrow? Dive in and embrace financial freedom with Advance Cash by Zindigi!